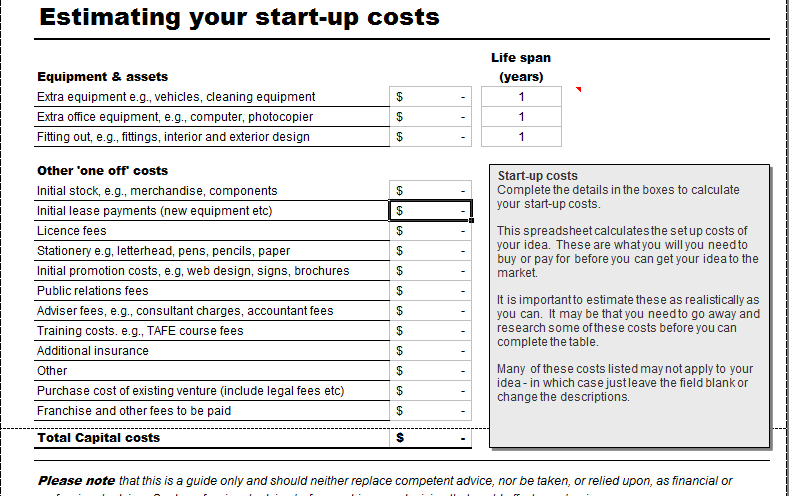

Working out your expenses can be a tricky task, especially if you run your own business. home office expense calculator NEED MORE HELP? You can calculate your potential home office expenses with our U.K. Since the latest budget has passed through. Your child is at university for 9 months a year but comes back to live at home for 3 months in the summer.įlat rate: 9 months x £500 per month = £4,500įlat rate: 3 months x £650 per month = £1,950 Select Self Employment to calculate your net income if you are a sole trader. For example, you and your partner run a bed and breakfast and live there the entire year. If someone lives at your business premises for part of the year, you can deduct only the applicable flat rate for the months they live there. Your overall business premises expenses are £15,000.įlat rate: 12 months x £500 per month = £6,000 To calculate the claimable spending, you must first calculate the total expenses for the premises and then apply the flat rate to subtract for your personal use.įor example, you and your partner run a bed and breakfast and live there the entire year. Now, if this is your only income and you’re not filing jointly with your spouse, then based on your tax bracket (9,700 taxed at 10, 29,775 taxed at 12, and 10,525 taxed at 22. Instead of working out the split between private and business expenditures regarding the use of the premises, a simplified expense rate can be applied. And let’s go ahead and say after business expenses, deductions and employment taxes (we’ll get to those next), you’re left with 50,000 in taxable income. An example of this scenario would be businesses such as bed and breakfasts, guesthouses, or small care homes whereby you reside on the site of your business. You can only claim work-from-home expenditure if you work for 25 hours or more a month from home.įlat rates for living on your business premises You can also use simplified expenses if you use your business premises as your home. You can claim the business proportion of these bills by working out the actual costs. It is important to note that the flat-rate method does not include telephone or internet expenses and these need to be calculated separately. This method of claiming deductions is based upon a flat-rate method rather than calculating each expense.Īllowable expenses can be calculated by using a flat rate based on the hours you work from home each month. It is also possible to claim allowable expenses without requiring time-consuming calculations and record-keeping. One method for calculating how much you can claim is to divide the number of rooms used for your business by the total number of rooms in your home. Home expenses that can be claimed include, but are not limited to: Therefore as home expenses are nearly always used for part-personal reasons, the expense is only part-claimable. Only the portion of the expense that exists solely for work purposes can be claimed. Those who are employed only can often discuss claiming with their employer to ensure maximum tax savings. Home expenses can also be claimed by companies. Working from home allowance is claimable by self-employed professionals.

#Business expenses calculator how to

home-office expenses calculator.įor a review and tailored advice on how to maximise your expenses book a call with one of our expense optimisation accountants. Individuals with total receipts of more than £1,000 can elect to calculate all of their profits by deducting the allowance instead of allowable business expenses (including capital allowances).

Read on to find out more about the home expenses you may be able to claim on your tax return this year.įor a quick calculation of the amount you maybe be able to claim, use our U.K.

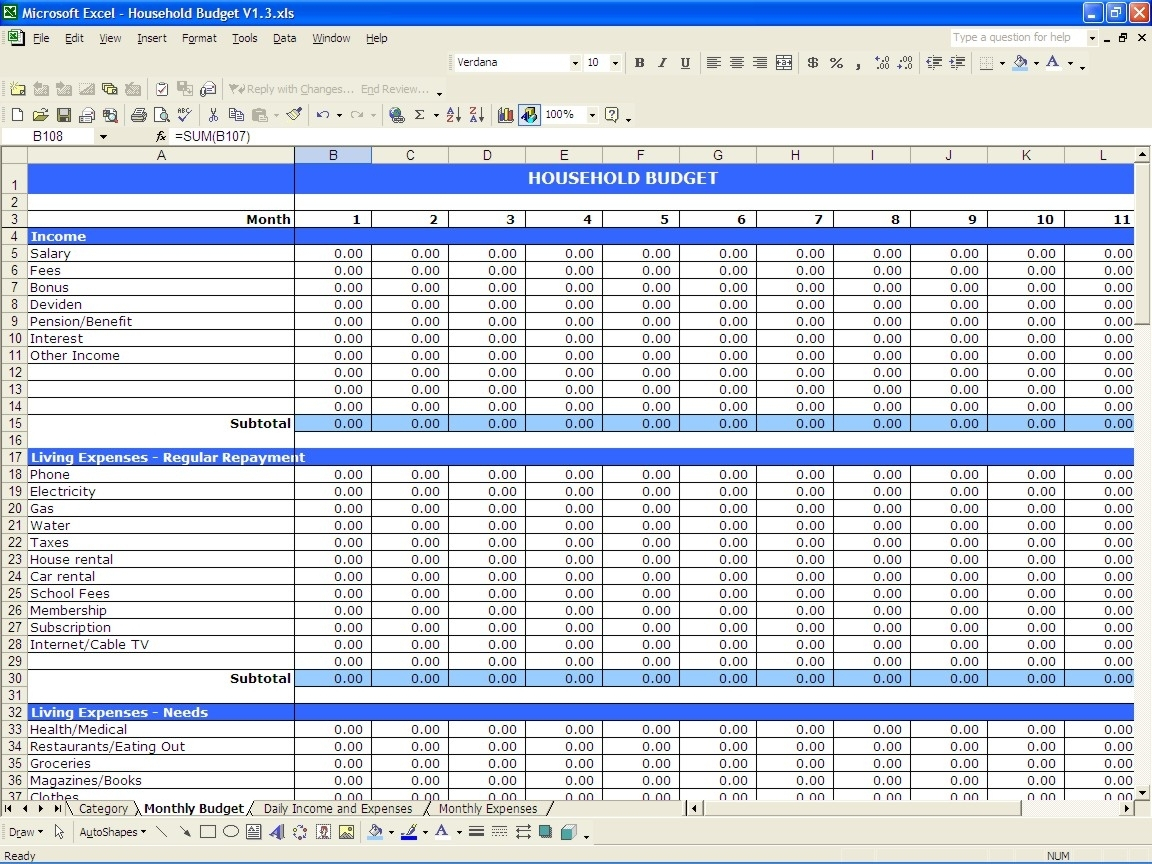

Every day we speak with tax filers who are not making the most of their claimable home expenses. You’ll be asked to make estimates about some of your business expenses.If you work from home, there are a number of expenses you may be entitled to. Use this checker to work out which method is best for you. calculate your expenses by working out the actual costs.If you’re a sole trader or partnership there are 2 ways you can calculate business expenses for vehicles, working from home and living on your business premises.

0 kommentar(er)

0 kommentar(er)